The Personal Website of Mark W. Dawson

Containing His Articles, Observations, Thoughts, Meanderings,

and some would say Wisdom (and some would say not).

Tax the Rich and Make Them Pay Their Fair Share

At the time of passage of the 16th Amendment to the Constitution, which allowed for Income Taxes, the American people were informed that most people would not be subject to Income Taxes. The Income Tax was to be a progressive tax that would only affect the wealthier people of the United States. The American people, therefore, thought that Income Taxes would not impact themselves. But like cancer, the Income Tax metastasized through the entire populace and eventually impacted almost all Americans.

When discussing the issue of taxing the rich, there is the question of what being rich means. When answering this question, the more apt word is wealth, as wealth is the amount of assets a person has, minus the amount of liabilities they have (i.e., wealth = assets – liabilities). Many rich people have assets, but they also have liabilities. When you calculate a person’s wealth, it is often less than you would presuppose. In the past, it was presumed that if you were a millionaire, you were wealthy. However, given inflation and the cost of living a million dollars is not what it used to be. A wealthy person is one who has sufficient wealth to be able to sustain a lifestyle that with prudent investment and expenditures, would not be too concerned about their future economic stability. Today, it is estimated that this would require about three million dollars of wealth to be rich. And three million dollars only sustains an upper-middle-class lifestyle. For any other lifestyle, it would be necessary to have over ten million dollars of wealth.

Taxing the rich is analogous to robbing Peter to pay Paul. It is also to assume that Peter has sufficient monies to be robbed and not be impacted by this theft. If the number or wealth of Peter's are reduced, and the number of Paul's is increased, then no amount of robbing can sustain neither Paul nor Peter.

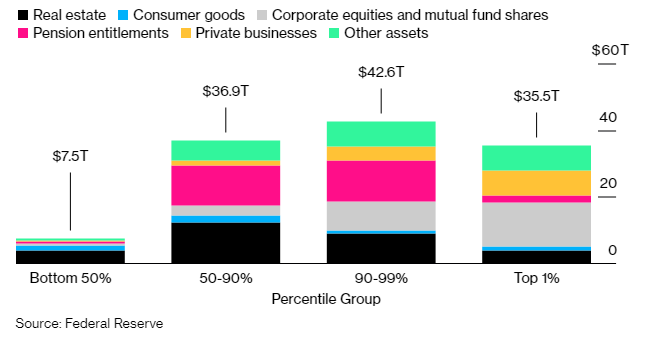

The most important utilization of these increased taxes would be for the paying down of the United States debts. Without paying down these debts, we run the risk of economic calamity. There are many ways to slice and dice the numbers and statistics of wealthy people in the United States. The Forbes 400 list of the richest Americans pegs their worth at about $2.96 trillion. As the current national debt stands at about 25.0 trillion dollars, you could confiscate all the assets of the 400 richest Americans and only pay 12.5% of the national debt. The other 87.5% would have to come from the non-400 richest Americans. To pay down the national debt would require not just a little more taxing, but would require much more taxes, and more taxes on both the upper and middle-class taxpayers in the United States. As to the wealth distribution in the United States It is estimated, by the Federal Reserve, that the top 1% has 35.5 trillion in assets, the 90-99% has 42.6 trillion in assets, the 50-90% has 36.8 trillion in assets, the bottom 50% has 7..5 trillion in assets. These estimates do not account for the liabilities that a person may have, and to determine the liabilities of a person is much more difficult than determining the assets of a person. These assets by percentile group can be seen in the following chart:

It is also estimated that in the United States, about 20% of the wealth is by inheritance, while the other 80% is self-made. Therefore, the United States affords the opportunity for someone to become wealthy through their own intelligence, hard work, skills, and abilities. These self-made wealthy people are also responsible for much of the economic growth and employment opportunities within the United States.

Taxing the rich could pay off the United States debt, but it could cause an economic collapse. There would be fewer wealthy people to invest in and grow the economy, which would cause the economy to slow down or collapse. This would mean less economic opportunity for the bottom 50% to obtain or retain employment. As the wealthy would have to sell off their assets to pay the taxes, there would be fewer wealthy people able to afford to purchase these assets, which would depress the value of these assets, which would require that the wealthy sell more of their assets to pay the taxes. As there would be fewer wealthy people available to purchase these assets, the only people who could afford to purchase these assets would be foreign governments or foreign nationals.

As to the argument that the wealthy are not paying their Fair Share of taxes, the following chart is helpful in determining who pays income taxes in the United States:

When people discuss the rich paying their fair share of taxes they often mean:

“Don’t tax you, don’t tax me, tax that fellow behind the tree!”

- Russell B. Long

Consequently, determining who should pay taxes and how much taxes they should pay is one of the most contentious questions of tax policies and politics.

There is also the question of ‘What is a fair share?’. The definition of “fair” is often different for each person. The more apt word is “equitable” - fair to all parties as dictated by reason and conscience. Even equitable is subject to debate. As can be seen from this chart, the top 10% of income earners pay 70% of the income taxes in the United States, while the bottom 90% of income earners pay 30% of the income taxes in the United States. The debatable question is then is this equitable?

Any discussion of taxes needs to include Payroll taxes as well as income taxes. Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their staff. Payroll taxes generally fall into two categories: deductions from an employee's wages and taxes paid by the employer based on the employee's wages. These types of taxes are generally Social Security, Medicare, and Medicaid (i.e., FICA taxes) and various insurances (e.g., unemployment and disability), and other taxes on employment. The following chart shows the combination of income and payroll taxes:

As can be seen from this chart, the wealthy pay less in payroll taxes than the less well off. This can be viewed as a counterbalance to the increase in income taxes the wealthy pay, but this counterbalance does not balance the scales of payments by both groups of taxpayers. It is also true that Social Security, Medicare, and Medicaid taxes are payments made in advance for the time when you will collect the benefits under these taxes. Often the beneficiaries of these taxes collect more than what they paid into these taxes. It is, therefore, more helpful to view these “taxes” as future “retirement” and “insurance” payments rather than taxes. As such, most people recoup their payroll taxes, while nobody recoups their income taxes.

There are also other forms of taxes that people pay that are impactful on their income. Tax systems in the U.S. fall into three main categories: regressive, proportional, and progressive, and two of the three impact high- and low-income earners differently.

- A regressive tax levies the same percentage on products or goods purchased regardless of the buyer's income and is thought to be disproportionately difficult on low earners.

- A proportional tax applies the same tax rate to all individuals regardless of income.

- A progressive tax imposes a greater percentage of taxation on higher income levels, operating on the theory that high-income earners can afford to pay more.

A proportional tax, also referred to as a flat tax, affects low-, middle-, and high-income earners relatively equally. They all pay the same tax rate, regardless of income. A progressive tax has more of a financial impact on higher-income individuals than on low-income earners. Regressive taxes have a greater impact on lower-income individuals than the wealthy. Regressive taxes include property taxes, sales taxes on goods, and excise taxes on consumables. Excise taxes are fixed, and they're included in the price of the product or service. "Sin taxes," a subset of excise taxes, are imposed on certain commodities or activities that are perceived to be unhealthy or have a negative effect on society, such as cigarettes, gambling, and alcohol. They are levied in an effort to deter individuals from purchasing these products. Sin tax critics argue that these disproportionately affect those who are less well off.

For more information on these types of taxes, I would direct you to the article on the Ivestopedia website, “The Difference Between Regressive, Proportional, and Progressive Taxes”. For more on taxes, I would recommend that you visit the website of the “Tax Foundation”.

* * * * *

Taxing the rich is often a form of coveting, which is against the Tenth Commandment of the Bible. When someone sees the prosperity, achievements, or talents of another, and then resents it, or wants to take it, or wants to punish the successful person, they are coveting another person. If someone gains something through moral, ethical, and legal means, then that something is theirs and is not subject to your coveting. Coveting is not a legitimate basis for taxing; indeed, it is an immoral and unethical means of taxing.

As can be seen from this article, the statements of “Tax the Rich” and “Their Fair Share“ have complex meanings and implications. Those that utilize these phrases rarely understand these meanings, complications, and implications. They often casually and thoughtlessly presume that the rich can afford the taxes and that there will be no or little risks to the economy, nor impacts to the middle or lower class by taxing the rich. In all these presumptions, they are wrong, and they pose an economic danger to all Americans if they should succeed in “Taxing the Rich” or making them “Pay Their Fair Share”.